TradeSmartOnline is one of the popular discount broker of India based out of Mumbai. It’s parent company is VNS Finance is in the brokerage field for more than 30 years.

In this TradeSmartOnline review, we will walk through all the aspect of the brokerage firm including brokerage, account opening and AMC charges, trading platforms and their benefits and drawbacks. We hope it will help you in making informed decision.

About TradeSmartOnline

TradeSmartOnline is an online discount brokerage subsidiary of VNS Finance & Capital Services Ltd that began operations in 2013. Its parent company has been in existence since 1994 and is listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India.

TradeSmartOnline adheres to regulatory requirements and holds memberships with various stock and commodity exchanges, including the Bombay Stock Exchange (BSE), National Stock Exchange (NSE), MCX Stock Exchange (MCX-SX), Multi Commodity Exchange (MCX), and National Commodity & Derivatives Exchange (NCDEX).

The company also complies with the rules and guidelines set by the Securities and Exchange Board of India (SEBI).

The company has experienced remarkable growth and has expanded its services to various segments. In 2015, it introduced its commodity trading platform, followed by its currency trading platform in 2016.

In 2017, the company was recognized as one of the top three discount brokers in India by several financial publications.

TradeSmartOnline has won numerous awards for its innovative and cost-effective brokerage plans and it is one among the reputed demat account providers of India.

TradeSmartOnline Brokerage Charges – 2024

As you can see. the brokerage firm offers two different kind of trading plan and customer can select anyone of the plan which suits him. The plans can be switched at any time.

The value plan basically suits the small investors who does not transact much. And the Power plan suits the traders like day traders.

In powerplan the brokerage is fixed and does not charge depending upon the transacted value.

TradeSmartOnline Account Opening and AMC Charges

- TradeSmartOnline Demat Account Opening Charges : Rs 200

- TradeSmartOnline AMC Charges : Rs 300/year

TradeSmartOnline Trading Platforms

TradeSmartOnline provide all three types of platforms namely desktop, web and mobile based one for its custmers. Some are from third party and some are inhouse built.

NEST Trader:

The flagship trading platform of TradeSmartOnline, NEST Trader, is an advanced desktop-based platform designed for active traders.

This cutting-edge platform is highly sophisticated and offers a plethora of advanced features such as customizable hotkeys, market depth, and multiple charting options.

Traders can access real-time data, trade alerts, and other analytical tools that help them make informed decisions and maximize their trading prowess.

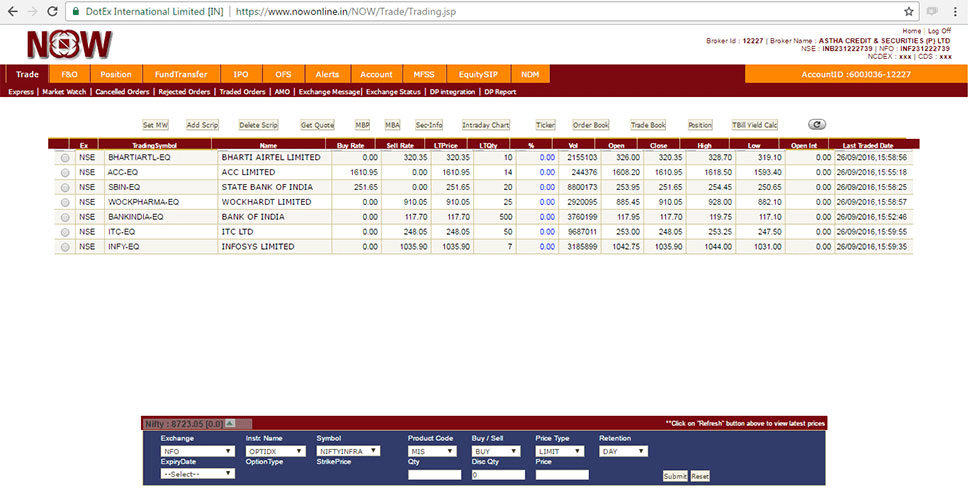

NSE NOW

NSE NOW is a web-based trading platform that is user-friendly and designed for traders who prefer simplicity and ease of use.

This platform offers real-time market data, streaming quotes, and charts that enable traders to stay ahead of the curve in a dynamic trading landscape.

NSE NOW also allows traders to place orders directly from the charts, making trading more seamless and efficient than ever before.

Sine Mobile

Sine Mobile is TradeSmartOnline’s mobile trading app, available for both Android and iOS devices.

This app is a powerful tool that offers traders real-time market data, advanced charting tools, and the ability to trade directly from their mobile devices.

Traders can customize watchlists and receive real-time trade alerts, empowering them to stay on top of their trades and make the most informed decisions possible.

Trading APIs

Trading APIs are a game-changer for traders who want to automate their trading strategies. TradeSmartOnline offers APIs (Application Programming Interfaces) that are available in multiple programming languages such as Java, .NET, and Python.

This feature allows traders to customize their strategies and trade automatically, with greater efficiency and precision than ever before.

Other Useful Tools

TradeSmartOnline also provides a range of other tools that can help traders manage their risk and optimize their trading outcomes.

These tools include a margin calculator, brokerage calculator, and a currency converter. By utilizing these tools, traders can make more informed trading decisions and enhance their overall performance.

Pros and Cons of using TradeSmartOnline

Advantages :

- Low brokerage charges: TradeSmartOnline is renowned for its economical brokerage fees, which are among the most affordable in the Indian brokerage industry. The brokerage cost is dependent on the selected trading plan, and clients can choose from a variety of plans based on their specific trading requirements.

- Advanced trading platforms: TradeSmartOnline offers advanced trading platforms like NEST Trader and Sine Mobile, which are expertly designed to cater to the needs of active traders. These innovative platforms provide a range of sophisticated features like customizable hotkeys, market depth, multiple charting options, and real-time data to enhance the trading experience.

- Multiple trading segments: TradeSmartOnline provides trading services in multiple segments, spanning diverse domains like equities, commodities, currencies, and derivatives, resulting in numerous trading opportunities that help traders diversify their portfolios and maximize their returns.

- Research and analysis: TradeSmartOnline is acknowledged for its comprehensive research and analysis reports, which offer traders valuable insights and information to help them make informed trading decisions. The brokerage firm also provides tools such as margin calculators and brokerage calculators to help traders strategize their trades.

Disadvantages :

- No physical branches: Notably, TradeSmartOnline is a web-based brokerage firm with no physical branches, which could be inconvenient for traders who prefer face-to-face interactions with their brokers.

- No 24/7 customer support: TradeSmartOnline’s customer support is only available during trading hours, which may be disadvantageous for traders who require assistance outside of those hours.

- Limited investment options: Compared to full-service brokerage firms, TradeSmartOnline presents a limited range of investment options, which may not suit traders who wish to invest in a wider variety of securities.

- Additional charges: While TradeSmartOnline’s brokerage fees are low, additional charges for ancillary services such as call-n-trade and SMS alerts may accumulate over time.

TradeSmartOnline Contact Details :

- Customer Care: +91-22-61208000 (Monday to Friday, 9:00 AM to 6:00 PM)

- Email: support@vnsfin.com

- Head Office Address: VNS Finance & Capital Services Ltd., 2nd Floor, B Wing, Trade World, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400013

Trade Smart Online User Reviews and Customer Ratings

| TradeSmartOnline Customer Ratings | |

| Brokerage Charges & Fees | 9.00/10 |

| Trading Platforms | 8.90/10 |

| Products & Services | 9.15/10 |

| Experience | 9.45/10 |

| Overall Ratings | 8.95/10 |

| Star Ratings | ★★★★ |

TradeSmartOnline Review – Final Thoughts

Ultimately, it can be concluded that TradeSmartOnline is an excellent choice for traders seeking an online-exclusive brokerage firm with low brokerage charges.

The firm offers various trading plans to suit different styles and budgets, and its charges are comparable to other discount brokers in India.

TradeSmartOnline’s cutting-edge trading platforms, comprehensive research and analysis tools, and diverse trading segments make it an attractive option for active traders. While customer support is responsive and helpful, it is only available during trading hours, and the lack of physical branches may be a disadvantage for some traders.

Overall, TradeSmartOnline is a reliable and trustworthy brokerage firm that offers a range of trading services and tools to help traders make informed decisions.

If you already have demat account with TradeSmart, please share your review and ratings for the brokerage firm.

TradeSmartOnline Securities FAQs

Q. Who is the parent company of Tradesmartonline?

A. TradeSmartOnline is a brand name of VNS Finance & Capital Services Ltd., which is the parent company of TradeSmartOnline. VNS Finance & Capital Services Ltd. is a Mumbai-based financial services company that offers a range of services

Q. What is turnover charges in Tradesmartonline?

A. Turnover charges are fees charged by the stock exchanges for executing trades. The charges are calculated as a percentage of the traded value of the transaction and are paid by the brokerage firm to the exchange.

Turnover charges of Tradesmartonline is as follows

- Equity Delivery: 0.00325%

- Equity Intraday: 0.00325%

- Equity Futures: 0.0021%

- Equity Options: 0.05%

- Currency Futures: 0.00135%

- Currency Options: 0.04%

- Commodity Futures: 0.003%

Q. What is 0.7% plan in Tradesmartonline?

A. The 0.7% plan is a brokerage plan offered by TradeSmartOnline for trading in the Indian stock market. Under this plan, the brokerage charged is 0.7% of the turnover value for equity delivery trades, with a minimum brokerage of Rs. 0.007 per share. This means that if you buy shares worth Rs. 10,000 under the 0.7% plan, the brokerage charged by TradeSmartOnline would be Rs. 70 (0.7% of Rs. 10,000).

Don’t Miss to Read Articles Related to TradeSmartOnline Demat Account: