In today’s digital age, the financial industry has undergone significant transformation, especially regarding the handling of securities. One such transformation is the process of dematerialization, which revolutionizes how investors manage their shareholdings.

In this article, lets understand dematerialization, its significance, advantages, and the step-by-step process of converting physical share certificates to demat form.

What is the Dematerialization Process?

Dematerialization, commonly known as “demat,” is the conversion of physical share certificates into electronic form.

Instead of holding tangible paper documents, dematerialization enables investors to hold their securities in a demat account, which functions akin to a digital wallet for shares.

This process is facilitated by depositories such as the National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL) in India.

Related Read : How to add nominee in the Demat account?

Difference Between Dematerialization and Re-materialization

While dematerialization involves converting physical shares into electronic form, re-materialization is the reverse process of converting dematerialized shares back into physical certificates.

Below table captures the major differences,

| Aspect | Dematerialization | Rematerialization |

|---|---|---|

| Nature of Conversion | Converting physical shares into electronic form | Converting electronic shares into physical certificates |

| Process Duration | Swift process, typically online | Can take up to 30 days, involves physical paperwork |

| Liquidity | Shares are tradable electronically | Shares become illiquid, cannot be traded |

| Identification | Unique ISINs | Distinct numbers |

| Maintenance and Fees | Annual maintenance charges apply | No maintenance charges for physical shares |

| Security | Stored electronically in secure depositories | More susceptible to theft/forgery |

Why Dematerialization? Advantages of Dematerialized Shares

Shares held in demat form offer several advantages over their physical counterparts.

Convenience and Efficiency: Dematerialized shares stored electronically in a demat account offer unparalleled convenience and efficiency. Investors can access, manage, and trade their holdings anytime, anywhere, through online platforms provided by registered stock brokerage firms. This eliminates the need for physical share certificates and streamlines the entire process of shareholding.

Reduced Risk and Enhanced Security: Holding shares in dematerialized form significantly reduces the risk of loss, theft, or damage associated with physical certificates. Electronic shares are stored securely in depositories, employing advanced encryption and authentication protocols to safeguard investors’ assets. This ensures enhanced security and peace of mind for investors.

Streamlined Transactions: Dematerialization facilitates seamless and efficient trading by enabling electronic transactions. Investors can buy, sell, or transfer shares with ease through online trading platforms, eliminating the need for cumbersome paperwork and physical share transfers. This not only saves time but also minimizes the risk of errors associated with manual processing.

Cost Savings: Transitioning to dematerialized shares results in significant cost savings for investors. Unlike physical certificates that incur storage and handling charges, dematerialized shares entail lower transaction costs and eliminate expenses associated with physical documentation and postage. Moreover, annual maintenance charges for demat accounts are nominal compared to the expenses incurred in maintaining physical holdings.

Enhanced Accessibility and Transparency: Dematerialization enhances accessibility and transparency in shareholding by providing investors with real-time access to their top demat account holdings and transaction history. Electronic statements and online portals offer comprehensive insights into investment performance, dividends, corporate actions, and portfolio diversification, empowering investors to make informed decisions.

Process for Converting Physical Shares to a Demat Account

Converting physical shares to demat involves a systematic process facilitated by registered stock brokerage companies. Here’s a step-by-step guide:

- Choose a Stock Brokerage Company: Select a reputable brokerage firm that provides demat account services. Ensure that the broker is registered with NSDL or CDSL.

- Open a Demat Account: Complete the necessary paperwork and submit the required documents, including identity proof, address proof, and PAN card. Once your demat account is opened, you will receive a unique demat account number (DP ID).

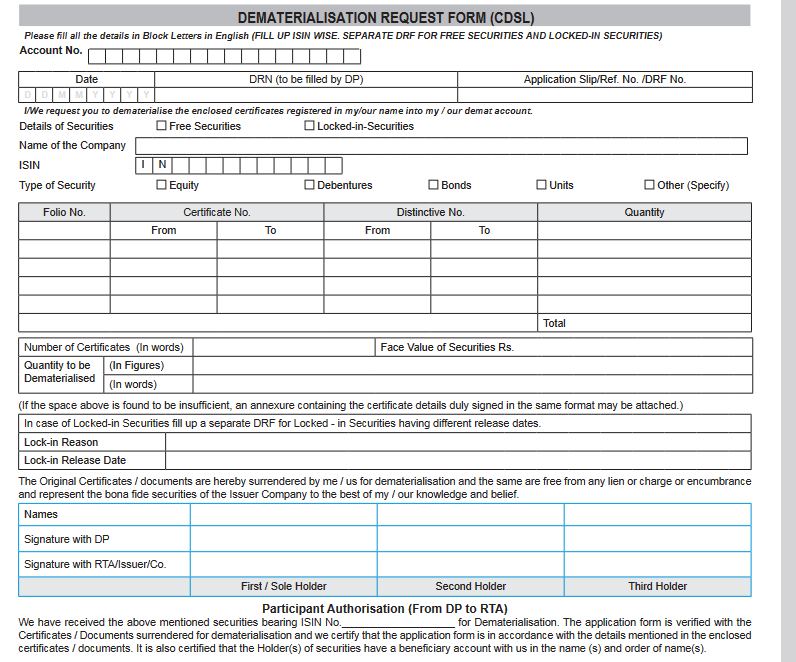

- Submit Share Certificates: Submit your physical share certificates along with a dematerialization request form (DRF) to your chosen brokerage firm. Ensure that the certificates are duly signed and stamped by the shareholder(s).

- Verification and Processing: The brokerage firm will verify the authenticity of the share certificates and initiate the dematerialization process with the respective depository (NSDL or CDSL).

- Credit of Shares: Upon successful dematerialization, the electronic equivalent of your shares will be credited to your demat account. You will receive an electronic statement reflecting the updated holdings.

A typical DRF forms looks like below

Documents Required to Convert Physical Share Certificate to Demat

To convert physical share certificates to demat, the following documents are typically required:

- Dematerialization Request Form (DRF): Provided by the brokerage firm, this form contains essential details such as shareholder information, share certificate details, and demat account information.

- Physical Share Certificates: Original share certificates to be converted into electronic form. Ensure that the certificates are properly endorsed and signed as per the guidelines.

- KYC Documents: Identity proof, address proof, and PAN card copies of the shareholder(s) as mandated by regulatory requirements.

Related Read : How safe is demat account in India? – 5 Safest demat accounts

Conclusion

Dematerialization represents a significant milestone in the evolution of the stock market, offering investors a secure, efficient, and transparent way to hold and trade securities.

By converting physical shares to demat form, investors not only safeguard their investments but also adopt the digital transformation driving the financial industry forward.

As the world moves towards electronic trading and paperless transactions, dematerialization emerges as a cornerstone of modern investment practices, fostering a more streamlined and investor-friendly ecosystem.

In conclusion, the process of converting physical shares to demat is a straightforward yet important step for investors seeking to leverage the benefits of electronic trading and data safety offered by dematerialization.

Check Out Below Informational Articles Related to Demat Account:

- How to freeze and unfreeze your demat account

- Types of Demat Account in India

- Can a Person Have Multiple Demat Account in India? Is it Legal?

- Minimum Amount Required For Opening A Demat Account

- Basic Service Demat Account – Benefits & Drawbacks

- Difference Between Demat and Trading Account

- When Are Bonus Shares Credited in Demat Account?

- Is Demat Account Safe? 5 Safest Demat Account In India

- What is Demat Account Holding Statement and How to Download it?

- Understanding the Advantages and Disadvantages of Demat Accounts

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open a Joint Demat Account – Benefits

- How to Add a Nominee to Your Demat Account?

- Demat Account Number Format : How To Find Your Demat Account Number?

- How To Close Your Demat Account Online?