In today’s fast-paced world of finance, the Demat Account stands as a symbol of the stock market revolution, offering investors a seamless pathway to trade and manage their securities.

It is very important to aware about the Demat account number, because you will need this in all your future correspondence with your broker.

Finding your Demat Account Number is first step in managing your investment portfolio effectively. Whether you’re a seasoned investor or a newcomer to the stock market, understanding how to locate your Demat Account Number is important.

In this article, we’ll explain about Demat Account Numbers, exploring their format, importance, and most importantly, how to retrieve them.

What Is a Demat Account Number?

A Demat Account Number, often referred to as a Demat ID, is a unique combination of numbers assigned to an investor by a Depository Participant (DP).

It serves as an electronic record-keeping system for securities such as stocks, bonds, mutual funds, and government securities.

Also read : How to Convert Physical Share to Demat Account Format

Importance of Demat Account Number

Gone are the days of physical share certificates; now, transactions occur seamlessly through electronic means. Investors can access their investment portfolio at the click of a button, thanks to the Demat Account Number.

Every demat account will have a account number which will help in many ways.

- Essential for Transactions: The Demat account number is indispensable for buying and selling securities in the financial market. It serves as your unique identifier, facilitating seamless transactions.

- Managing Multiple Accounts: For investors with multiple Demat accounts, the account number simplifies the process of segregating investments. It enables systematic organization of portfolios across different accounts.

- Transaction Tracking: The Demat account number serves as a reference point for tracking transactions. It allows investors to monitor their investment activities and ensures transparency in dealings.

- Resolving Discrepancies: In case of transactional discrepancies or disputes, the Demat account number serves as a vital tool for seeking redressal. It provides a unique identity for resolving issues effectively.

- Facilitates Investor Communication: Companies and regulatory bodies use Demat account numbers for communication purposes with investors. It streamlines communication channels and facilitates timely updates on investments.

What Is the Demat Account Number Format?

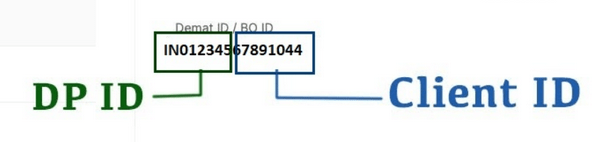

The Demat account number is a 16 digit number and it is a combination of two elements of 8 digits each:

- DP ID (Depository Participant Identification): This is a unique number assigned to financial entities such as banks, brokers, etc., by depository institutions like NSDL or CDSL. When a customer opens a Demat account with any of these entities, the first 8 digits of the 16-digit Demat account number represent the DP ID, signifying the institution where the Demat account was opened.

- Customer ID: The subsequent 8 digits of the 16-digit Demat account number constitute the customer ID. This ID is allocated to each individual investor by the stockbroker or financial institution with whom they open a Demat account. These 8 digits are exclusive to each investor and serve as their unique identifier within the institution’s records. It’s important to note that no two investors will have the same customer ID.

The format of the Demat account number varies based on the CDSL or the NSDL. It is made of 16-digit numeric characters in CDSL, whereas in NSDL, it starts with “IN” followed by a 14-digit numeric code.

Demat Account Number format in NSDL:

In NSDL, the Demat Account Number, also known as the Demat ID, is a 16-digit unique identifier assigned to the account holder. The format of the Demat Account Number in NSDL begins with “IN” followed by a 14-digit numeric code.

An example of a Demat Account Number with NSDL could be “IN01234567891234”.

Demat Account Number Format in CDSL :

In CDSL, the Demat Account Number is also a 16-digit unique identifier assigned to the account holder. Unlike NSDL, the format of the Demat Account Number in CDSL consists of 16-digit numeric characters.

An example of a Demat Account Number with CDSL could be “01234567890123456”.

How to Know the Demat Account Number?

When you open a Demat Account with a DP, they provide you with the Demat Account Number. You might have received email with all details about it. You need to search for that mail in inbox which will have all the details.

If you dont have that mail, dont worry, you can still get the demat account number from the broker website.

Below are the steps following which you can access the details of demat account number in Zerodha ( We have explained taking example of Zerodha). For other brokers, steps may differ but the process remains the same.

- Visit console.zerodha.com/dashboard.

- Enter your User ID and Password

- Enter your app code which was sent to your Kite Mobile app

- Click on the “Account” button on top right

- Scroll down and click on “Demat” button on left side

- Under the Demat ID section, you will find your Demat Account number

How To Know a Demat Account Number Using a PAN Card?

Linking your PAN card with your Demat Account is a mandatory requirement by regulatory authorities like the Securities and Exchange Board of India (SEBI).

Through this linkage, investors can easily retrieve their Demat Account Number using their PAN card, either through online portals or by contacting their DP.

Best is to search for the email inbox from DP for the PAN Card number. You will also get details of Demat account number in that email.

Also read : How To Close Your Demat Account – Detailed procedure

Conclusion

In conclusion, the Demat Account Number is not just a series of digits; it’s a gateway to the world of financial securities.

Just like your bank account number, it is important for you to know and save the details of them with you.

You need to quote it whenever you are asked. Knowing the format of the demat account will help you to easily understand and use the demat account.

Check Out Below Informational Articles Related to Demat Account:

- Can a Demat Account Be Opened Without a PAN Card?

- Difference Between Demat and Trading Account

- Understanding the Advantages and Disadvantages of Demat Accounts

- What is Demat Account Holding Statement and How to Download it?

- How to Convert Shares in Physical Format to Demat Format

- Can a Person Have Multiple Demat Account in India? Is it Legal?

- How to freeze and unfreeze your demat account

- Is Demat Account Safe? 5 Safest Demat Account In India

- How to Open a Joint Demat Account – Benefits

- Basic Service Demat Account – Benefits & Drawbacks

- How To Close Your Demat Account Online?

- When Are Bonus Shares Credited in Demat Account?

- Minimum Amount Required For Opening A Demat Account

- How to Add a Nominee to Your Demat Account?

- Types of Demat Account in India