In the world of investments and financial planning, keeping your assets safe is absolutely essential. One of the key parts of this is making sure that your investments are well-guarded and can transition seamlessly in case something unexpected happens.

One way to safeguard your investments is by adding a nominee to your Demat account.

Who Is a Nominee?

Before getting into the process of adding a nominee to your preferred Demat account, let’s first understand what a nominee is.

A nominee is an individual chosen by the account holder to receive the benefits of the investments held in the Demat account in the event of the account holder’s demise.

Essentially, the nominee acts as a trustee who ensures that the assets are transferred to the rightful beneficiaries as per the wishes of the account holder.

Also Read : Is Demat account safe?

Why Should You Add a Nominee to Your Demat Account?

The inclusion of a nominee in your Demat account serves multiple purposes, all geared towards protecting your investments and streamlining the transfer process in case of unforeseen events.

Here are some compelling reasons to add a nominee:

- Asset Protection: By nominating someone, you ensure that your investments are protected and smoothly transferred to your chosen beneficiary/beneficiaries.

- Risk Reduction: Adding a nominee mitigates the risk of disputes and legal battles over the ownership and distribution of assets.

- Peace of Mind: Knowing that your investments will be managed and transferred as per your wishes provides peace of mind and financial security.

How Can You Add a Nominee to Your Demat Account?

Now, let’s explore the step-by-step process of adding a nominee to your Demat account:

- Understand the Legal Requirements: Before proceeding, familiarize yourself with the legal requirements and procedures mandated by regulatory bodies such as SEBI (Securities and Exchange Board of India).

- Obtain the Nomination Form: Contact your Depository Participant (DP) to obtain the nomination form. This form is also available on the websites of depositories such as NSDL and CDSL.

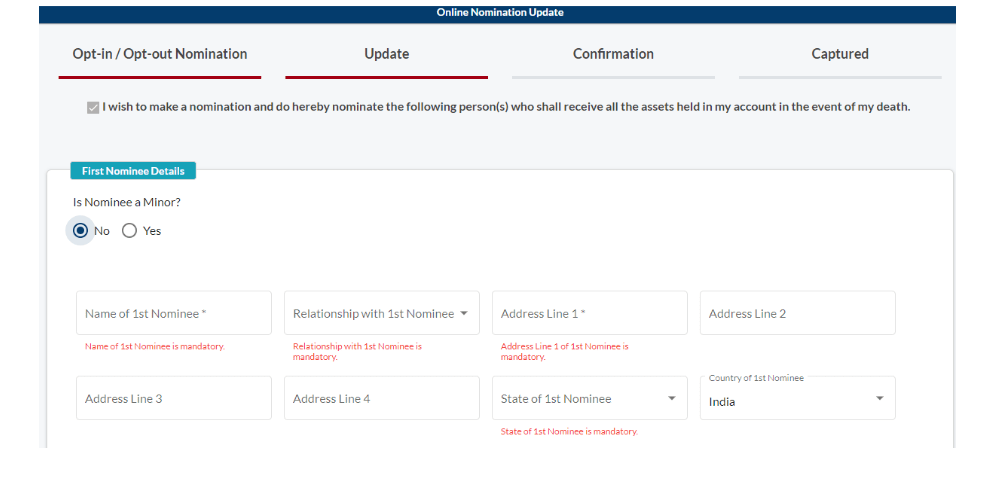

- Fill Out the Form: Provide accurate details such as the nominee’s name, address, relationship with the account holder, and percentage allocation of assets.

- Submit Supporting Documents: Along with the nomination form, submit supporting documents as required by your DP. These may include proof of identity, address, and guardian details if the nominee is a minor.

- Verification Process: The DP will verify the details provided in the nomination form and supporting documents. This is crucial to ensure the authenticity of the nomination.

- Activation: Once the verification is complete, the nominee will be activated in your Demat account, and you will receive confirmation of the same.

Steps to be Followed for adding a Nominee to Your Demat Account:

Now lets see how to add nominee by visiting NSDL website.

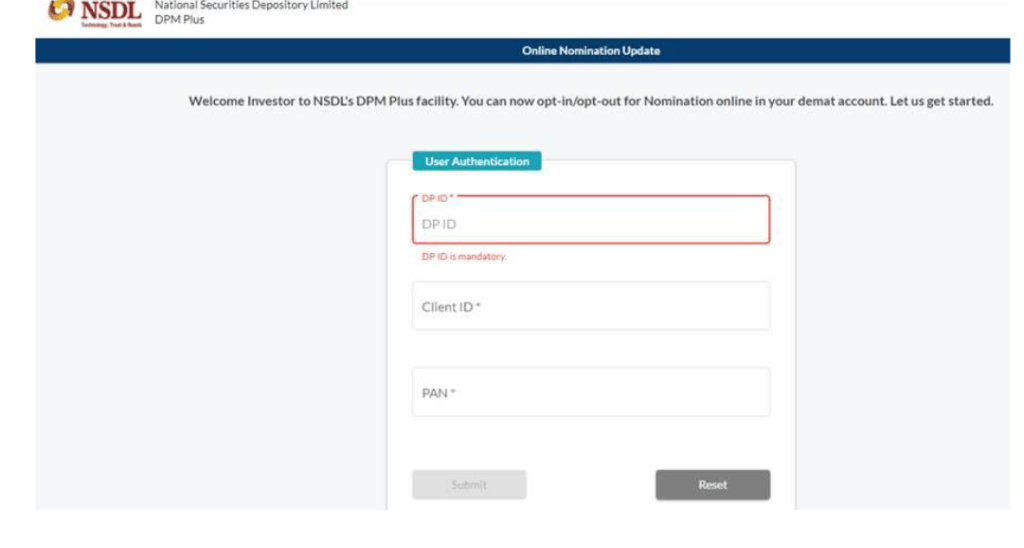

Step #1: Visit NSDL Website http://nsdl.co.in/dpmplus.php

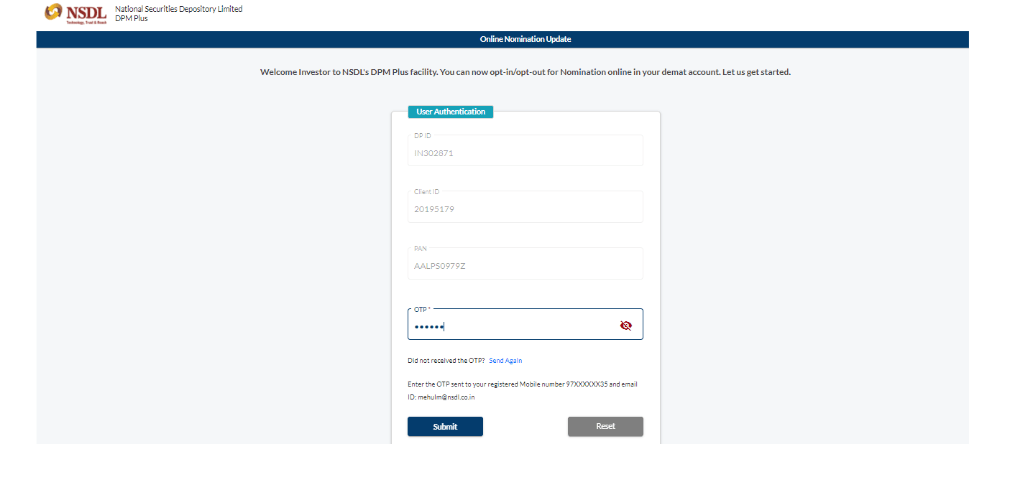

Step #2: Enter DP ID, Client ID and PAN number along with OTP sent to registered mobile number. (If you have not subscribed to this service, you need to first subscribe else error message is displayed)

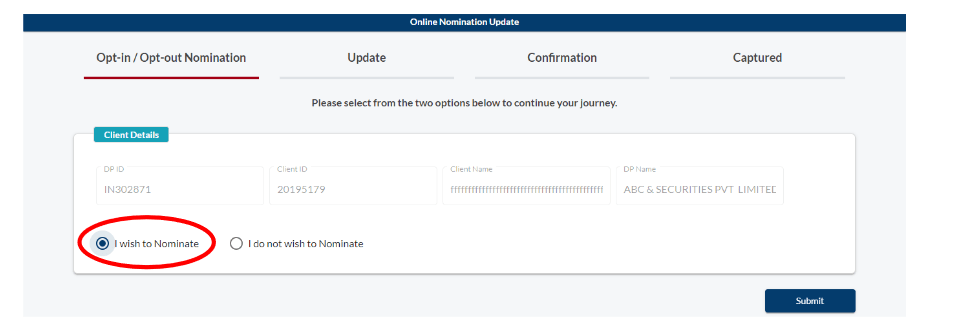

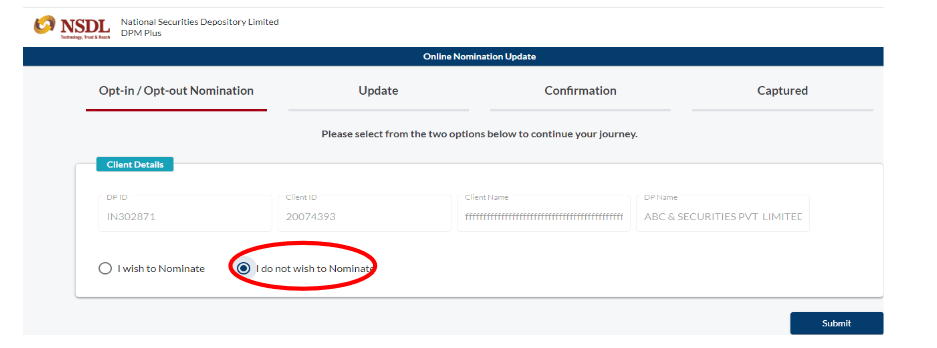

Step #3 : Once the correct details are entered, the window to opt or opt out for the nomination is displayed

Step #4 : Now you can add upto three nominees. Click Save and Next.

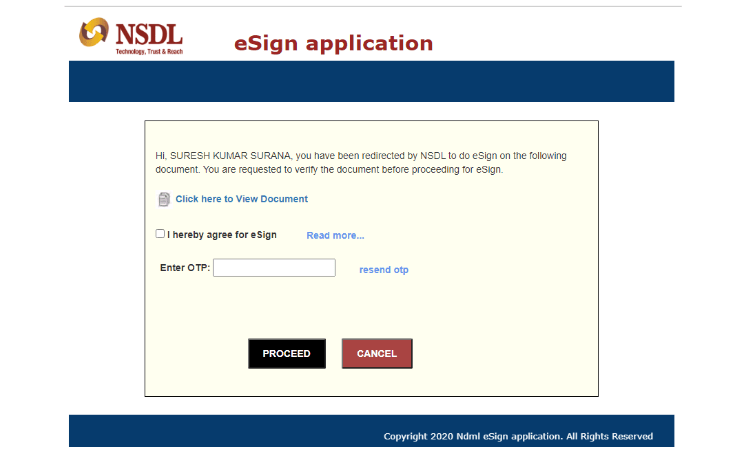

Step #5 : eSign the form by validating the OTP

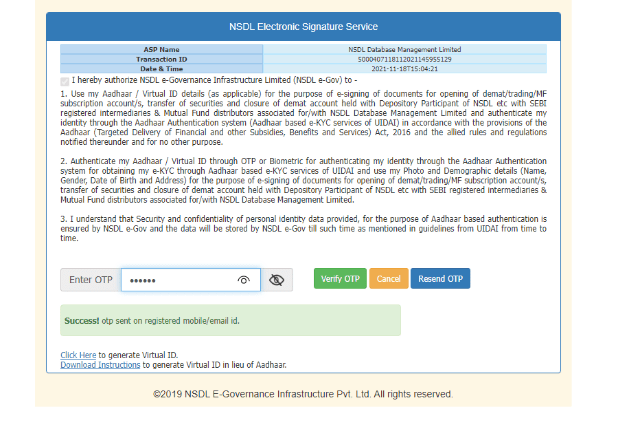

Step #6 : Now you will be redirected to Protean eGov for Aadhaar eSign

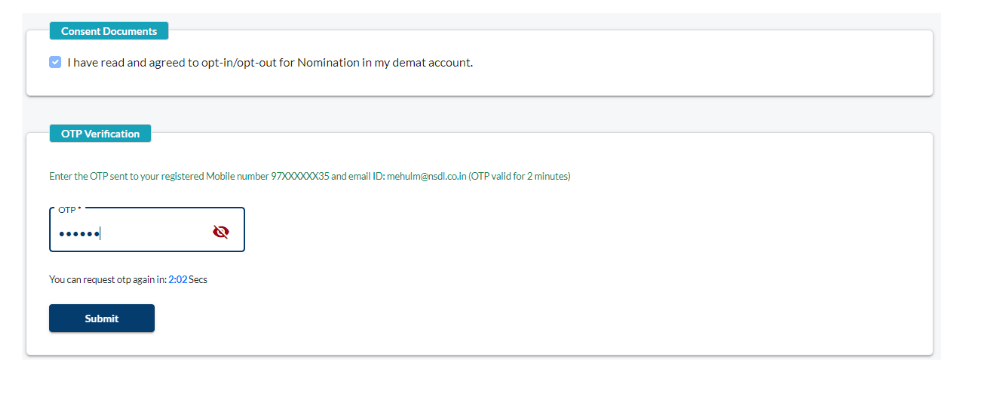

Step #7 : After aadhar eSign, you will be redirected to NSDL website and you need to submit OTP to complete the process

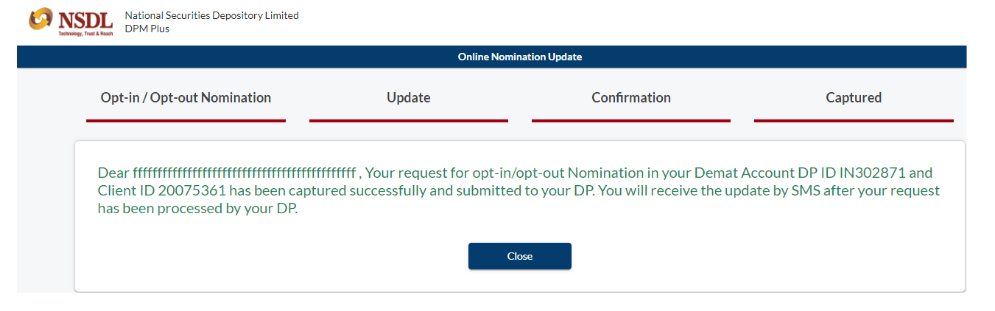

Step #8 : Success message will be dispayed as below.

Step #9 : Alternatively if you wish to opt out of nomination and dont want to add any nominee, you can select ” I do not wish to Nominate” option in Step #3.

If you have demat account with Zerodha, they have explained how to add nominee in their support portal here.

Things To Keep In Mind When Adding A Nominee To Your Demat Account

While adding a nominee to your Demat account, it’s essential to consider the following factors:

- Maximum Number of Nominees: Understand the maximum number of nominees allowed as per regulatory guidelines. Typically, a Demat account can have up to three nominees.

- Individual vs. Non-Individual Nominees: You can nominate individuals such as family members (parents, spouse, children, siblings) or non-individual entities like trusts, corporations, or societies.

- Percentage Allocation: Specify the percentage allocation of assets among multiple nominees if desired. This ensures clarity and prevents misunderstandings.

- Update Details Regularly: Keep your nominee details updated in case of any changes in personal circumstances such as marriage, divorce, or the birth of children.

Also note that,

- Non-Individual account are not allowed to have nominee

- If the nominee is a minor, you need to mention gaurdian details (Also, account holder can not be added as guardian)

- If the demat account is in the name of a minor, guardian can not be nominee

- If the demat account is opened as Joint account, nominee can be added only offline

- NRIs can also add nominee to their demat account

How to add a nominee(s) to the demat account offline?

To add nominee(s) to your Demat account offline, obtain the nomination form from your Depository Participant (DP) i.e stock broker, fill it with accurate details, and attach necessary documents.

Submit the completed form to your DP’s office, undergo verification, and await confirmation.

Keep records of the process for future reference. Periodically review and update nominee details as needed to ensure smooth asset transfer.

Also Read : Can You Open a Demat Account Without a PAN Card?

Conclusion

In conclusion, adding a nominee to your Demat account is a prudent step towards safeguarding your investments and ensuring their smooth transfer to your chosen beneficiaries.

By understanding the process and adhering to legal requirements, you can protect your assets and provide financial security to your loved ones. Take proactive steps today to secure your financial future.

Remember, the process of adding a nominee is simple yet crucial, offering peace of mind and protection against unforeseen events.

By incorporating a nominee into your Demat account, you not only protect your investments but also ensure that your loved ones are taken care of in your absence. Take action today to secure your financial legacy.

Check Out Below Informational Articles Related to Demat Account:

- Is Demat Account Safe? 5 Safest Demat Account In India

- Minimum Amount Required For Opening A Demat Account

- When Are Bonus Shares Credited in Demat Account?

- What is Demat Account Holding Statement and How to Download it?

- How To Close Your Demat Account Online?

- Demat Account Number Format : How To Find Your Demat Account Number?

- Difference Between Demat and Trading Account

- How to freeze and unfreeze your demat account

- Can a Person Have Multiple Demat Account in India? Is it Legal?

- Can a Demat Account Be Opened Without a PAN Card?

- Types of Demat Account in India

- How to Open a Joint Demat Account – Benefits

- Basic Service Demat Account – Benefits & Drawbacks

- Understanding the Advantages and Disadvantages of Demat Accounts

- How to Convert Shares in Physical Format to Demat Format