Groww started as direct mutual fund platform and now they have also ventured into equity market as stock broker.

In this Groww review, we will talk about all the aspect of the brokerage firm including brokerage, demat account opening and AMC charges, trading platforms and their pros and cons. We hope it will help you in making informed decision.

About Groww

Groww is an online investment platform that is rapidly expanding in India. Founded in 2016 with head office in Bangalore, it has become one of the most popular investment platforms in the country, with over 15 million users as on date.

Groww aims to democratize investing, making it accessible to everyone, irrespective of their financial knowledge or experience. The platform offers a range of investment options, including mutual funds, stocks, ETFs, and various others.

Additionally, Groww provides educational resources and investment advice to aid users in making informed investment decisions.

Apart from investment services, Groww has also introduced a range of financial products, including insurance, gold investment, and loans.

It is worth noting that the company has received significant investments from esteemed investors like Sequoia Capital India, Ribbit Capital, and Y Combinator.

Related Read : List of 11 leading demat account providing companies in India

Groww Brokerage Charges

As you can see, the delivery brokerage is not free while it is free in Zerodha. So if you deal mainly in delivery segment, then you may have to pay more in case of Groww.

Delivery segment refers to the trades where you buy shares and do not sell them on the same day. That means, all your investments belongs to delivery segment.

Groww Account Opening and AMC Charges

- Groww Demat Account Opening Charges : Nil

- Groww AMC Charges : Nil

As you can see, there is no charges for opening the account with Groww. Also, AMC charges are also waived off and it is the major differenciating factor of Groww compared to other stock brokers.

Groww Trading Platforms

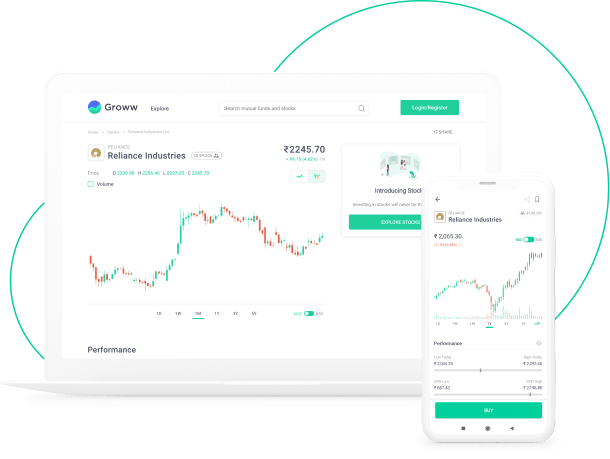

Groww furnishes its users with two main trading platforms to invest in: the Groww App and the Groww Web.

Groww Mobile App

The Groww App is a mobile application that enables users to invest in a vast array of financial instruments, including mutual funds, stocks, ETFs, and other comparable options.

The app is very user friendly and is compatible with both iOS and Android devices. Alongside its investment services, the app also provides various educational resources in the form of articles, videos, and tutorials to educate its users on the intricacies of investing.

Additionally, the app includes a SIP calculator, goal-based investing options, and portfolio tracking mechanisms to keep users informed of their investments’ performance.

Groww Web Platform Review

The Groww Web platform is a web-based trading platform that offers a more extensive range of investment services than its mobile app counterpart. It provides access to mutual funds, stocks, ETFs, bonds, and more.

The platform also features sophisticated research tools, such as technical charts and stock screeners, which can assist users in making informed investment decisions.

Accessible via any web browser, Groww Web presents a straightforward and intuitive interface, enabling users to monitor their investments, view their portfolio, and place orders in real-time directly through the platform.

Both the Groww App and Groww Web offer a seamless trading experience, ensuring that investing is accessible and straightforward for everyone.

Additionally, to provide top-notch customer service, both platforms offer round-the-clock support to assist users with any queries or issues they may encounter while navigating the platforms.

Pros and Cons of using Groww

pros

- Easy Account Opening: An enormous advantage of choosing Groww Demat is the hassle-free and straightforward account opening process. The entire procedure can be completed online in just a few minutes without the need for any physical documents or signatures, making it an ideal option for individuals who value convenience and speed.

- Zero Maintenance Charges: Groww Demat provides a cost-efficient alternative for small investors since it doesn’t levy any annual maintenance fees, which is a significant advantage for those looking to reduce their expenses.

- Seamless Integration with Groww App: One of the primary advantages of Groww Demat is its seamless integration with the Groww app, which enables investors to effortlessly monitor investments, place orders, and manage their portfolios from a single location. This level of coherence and integration is a significant benefit for users.

Cons

- Limited Investment Options: Although Groww Demat may suit some investors, it should be noted that the platform provides a relatively limited selection of investment opportunities compared to other demat account providers. At present, users are only able to invest in stocks and ETFs available on the NSE and BSE exchanges.

- No Trading Terminal: One aspect that distinguishes Groww Demat from other demat account providers is the absence of a trading terminal for advanced trading functions. While this may not be a significant concern for novice investors, more experienced traders may find it to be a significant disadvantage.

- No 3-in-1 Account: Another possible downside of utilizing Groww Demat is the lack of a 3-in-1 account option that is linked to a savings account and trading account. This is not a must have feature for a investor but a 3-in-1 account has advantage of seamless movement of funds.

Key Features of Groww

- User-Friendly Interface: The platform’s layout is imbued with an intuitive and user-friendly design that enables seamless navigation, even for individuals new to the investing realm.

- Instant Fund Transfer: Groww Demat facilitates swift and informed investment decisions through its real-time fund transfer option, allowing users to quickly transfer funds from their bank account to their demat account.

- One-Click Investment: Groww Demat’s one-click investment feature is a blessing for those seeking to invest in stocks and ETFs with speed and ease, requiring only a few well-placed clicks.

- Consolidated View of Investments: Groww Demat provides users with a comprehensive and consolidated overview of their entire investment portfolio, allowing for effortless monitoring of their investments’ overall performance.

- Advanced Security Measures: Utilizing advanced security measures such as two-factor authentication and SSL encryption, Groww Demat ensures the security of its users’ data and transactions, preventing malicious individuals from causing harm.

Groww Contact Details :

Email: support@groww.in

Phone Number: 080-47105555 (Monday to Saturday, 9:00 am to 6:00 pm)

Address: Groww, NextBillion Technology Private Limited, Vaishnavi Tech Park, 3rd Floor, Sarjapur Main Road, Bellandur, Bengaluru – 560103 , Karnataka, India.

Groww User Reviews and Customer Ratings

| Groww Customer Ratings | |

| Brokerage Charges & Fees | 9.25/10 |

| Trading Platforms | 9.29/10 |

| Products & Services | 9.32/10 |

| Experience | 8.4/10 |

| Overall Ratings | 9.15/10 |

Groww Review – Final Thoughts

It is clear from a careful review of the material at hand that Groww is a very trustworthy and user-friendly demat account opening tool.

The organisation is a very affordable choice for savvy investors looking to take advantage of market chances because it offers free account opening and incredibly minimal brokerage fees.

The platform allows users to build a well-diversified portfolio by providing a wide choice of investment options, including gold, mutual funds, and equities.

Furthermore, Groww is a well-known and top option for inexperienced investors who need the highest level of accessibility and convenience due to its simple account opening process and user-friendly mobile application.

To sum up, Groww offers an unquestionable value proposition to investors looking for a simple and affordable way to enter the Indian stock market.

If you already have account with Groww, please provide your review and ratings for the benefit of readers through comment box below.

Frequently Asked Questions about Groww – FAQs

Q. Which company owns Groww?

A. Groww is owned by Nextbillion Technology Private Limited, which is a Bangalore-based company.

Q. Can I invest Rs100 in Groww?

A. Yes, you can invest Rs 100 in Groww. Groww allows users to invest in mutual funds with a minimum investment amount of just Rs 100. However, please note that the minimum investment amount for stocks and ETFs may vary and it is always recommended to check the platform for the latest information regarding investment minimums.

Q. Is Groww completely free?

A. No. Groww does not charge any account opening or annual maintenance fees . but there are certain charges associated with transactions on the platform, such as brokerage charges and transaction charges. These charges are standard for any stockbroking or investment platform in India. Groww strives to keep its charges as low as possible to offer a cost-effective investing experience to its users.

Q: How do I add money to my Groww account?

A: You can add money to your Groww account through various payment modes, including net banking, UPI, debit card, and credit card.

Q: How can I contact Groww customer support?

A: You can contact Groww customer support through their app or website, or by calling their toll-free number.

Q: Can I use Groww on my desktop or laptop?

A: Groww is primarily a mobile-based platform, but users can access it through their web browser on desktops or laptops.

Dont Miss to Read Article Related to Groww Demat Account: