HDFC Securities was incorporated in 2000 and belongs to full service broker category. The company is registered with SEBI and has affiliation to NSE, BSE, MCX, NSDL and CSDL.

In this HDFC Securities review, we will talk about all the aspect of the brokerage firm including brokerage, account opening and AMC charges, trading platforms and their pros and cons. We hope it will help you in making informed decision.

About HDFC Securities

HDFC Securities is a reputable full-service brokerage company in India that provides a wide range of financial products and services to both institutional and retail customers.

It is a subsidiary of HDFC Bank, which is one of the largest private banks in India. HDFC Securities offers various services such as equity and derivative trading, commodity trading, currency trading, mutual funds, IPOs, bonds, and fixed deposits, as well as insurance.

The company operates through multiple channels, including online trading platforms, mobile trading applications, and branch offices situated throughout India.

HDFC Securities’ trading platforms are easy to use, and the company offers research and advisory services as well as 24/7 customer support.

Additionally, it has a solid compliance and risk management framework, ensuring that clients’ trades are secure and reliable.

The HDFC Securities has emerged as one of the top 10 demat account provider of India.

Key Features of HDFC Securities

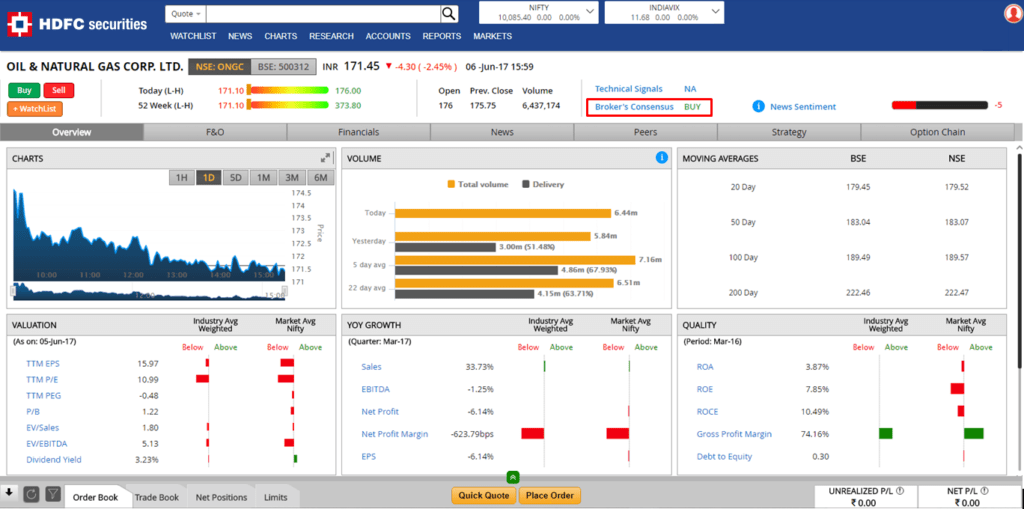

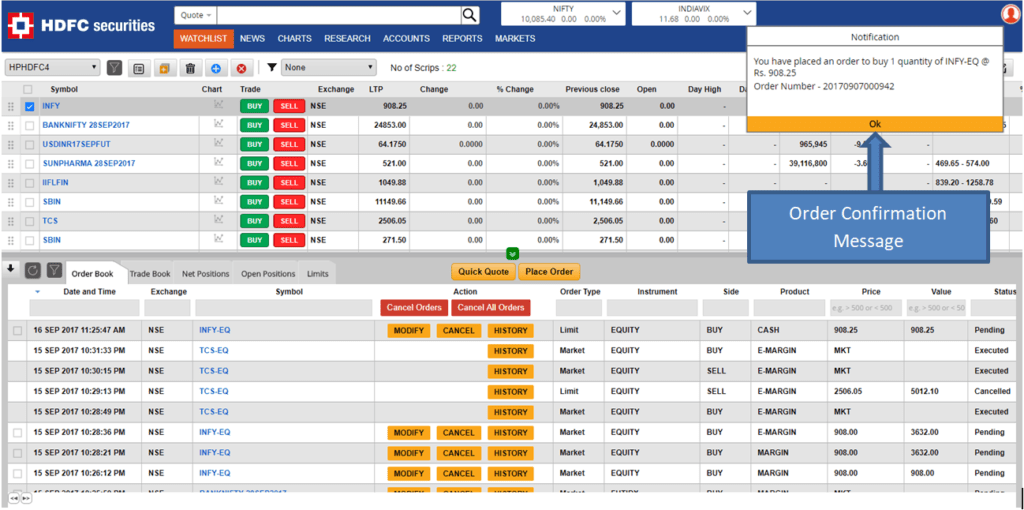

- Multiple Trading Platforms: HDFC Securities boasts an impressive collection of trading platforms that are unparalleled in the industry. These include ProTerminal, ProWeb, and mobile trading apps, which offer real-time market data, advanced charting tools, and technical analysis indicators. These tools empower clients to make data-driven investment decisions that are grounded in insights.

- Wide Range of Financial Products: HDFC Securities is a force to be reckoned with in the financial products and services industry, offering a wide range of investment options such as equities, derivatives, mutual funds, IPOs, bonds, and fixed deposits. The level of diversification available to clients is unmatched, providing flexibility and access to a multitude of unique investment opportunities.

- Research and Advisory Services: Investing knowledge is crucial, and HDFC Securities understands this. That’s why it offers extensive research and advisory services to keep clients informed of the latest market trends and insights. These services include regular market updates, recommendations, deep-dive insights, and analysis.

- Strong Compliance and Risk Management: Safety and security are paramount when investing, and HDFC Securities takes this seriously. The company has implemented a robust compliance and risk management framework to prevent fraud and unauthorized access, safeguarding clients’ personal and financial information.

- Customized Investment Solutions: HDFC Securities offers customized investment solutions tailored to each client’s unique investment goals and risk tolerance. Expert investment advisors work closely with clients to create personalized investment plans aligned with their needs and objectives.

- Customer Support: HDFC Securities understands the importance of customer support and has created a dedicated team available through multiple channels, including phone, email, and live chat. Clients can rest assured that they have access to top-tier customer support.

- Education and Training: HDFC Securities provides clients with the knowledge and tools they need to succeed in the financial markets. The company offers an extensive range of education and training materials such as webinars, tutorials, and other resources, to help clients improve their understanding of the financial markets and enhance their trading skills.

HDFC Securities Brokerage Charges

As you can see. the brokerage charges are very high and make them not at all suitable for trading purpose. If you are investor, then you can still choose them, but for day trading you should choose a discount broker who charge very less brokerage.

HDFC Securities Account Opening and AMC Charges

- HDFC Securities Demat Account Opening Charges : Rs 999

- HDFC Securities AMC Charges : Rs 750 second year onwards

HDFC Securities Trading Platforms

HDFC Securities takes the initiative to offer its customers multiple trading platforms that are tailored to suit the various preferences and requirements of different types of traders. T

hese platforms are crafted to provide a seamless and intuitive trading experience, while also providing a plethora of features and tools to aid in informed trading decisions.

Here are some of the trading platforms that HDFC Securities provides to its clients:

HDFC Sec Pro Terminal Platform

ProTerminal is a trading platform that is desktop-based and specifically designed for active traders. It offers real-time market data, customizable watchlists, advanced charting tools, and technical analysis indicators. Additionally, it supports trading in equity, derivatives, currency, and commodity segments.

Pro Web Platform

ProWeb is a web-based trading platform that can be accessed from any device with an internet connection. It provides live market updates, streaming quotes, advanced charting, and an integrated fund transfer facility. ProWeb is suitable for both novice and experienced traders.

HDFC Securities Mobile Trading App:

HDFC Securities offers a mobile trading app that can be downloaded on both Android and iOS devices. This app provides real-time market data, advanced charting tools, trading across multiple segments, and a range of other features that enable traders to stay connected to the markets while on-the-go.

Call-n-Trade:

HDFC Securities provides a Call-n-Trade facility for clients who prefer placing orders over the phone. With this service, clients can easily place, modify, or cancel orders over the phone while receiving real-time updates on their portfolio.

Moreover, HDFC Securities grants access to a variety of other resources and tools such as market research, news and analysis, trading tips, and educational materials to help clients make well-informed trading decisions.

Pros and Cons of using HDFC Securities

pros

- Wide Range of Financial Products: HDFC Securities presents an extensive range of financial products and services, offering a diverse selection of investment options such as equities, derivatives, mutual funds, IPOs, bonds, fixed deposits, and others. This wide range of choices empowers clients to diversify their portfolios, capitalize on fresh investment opportunities and tackle the intricacies of the modern financial environment.

- User-Friendly Trading Platforms: HDFC Securities provides a collection of trading platforms catering to clients’ requirements, including easy-to-use desktop, web-based, and mobile trading apps. These platforms deliver a rich set of advanced features, such as real-time market data, advanced charting, and technical analysis tools, empowering clients to make informed trading decisions, execute trades quickly and efficiently, and stay on top of market developments.

- Research and Advisory Services: HDFC Securities has a client-centric approach to research and advisory services, providing its clients with regular market insights, recommendations, and updates. This is particularly helpful for investors who lack the expertise or time to conduct their own research, enabling them to make informed investment decisions and stay updated on market trends.

- Strong Compliance and Risk Management: HDFC Securities prioritizes maintaining a robust compliance and risk management framework, ensuring the security and safety of its clients’ investments. The firm has implemented a comprehensive set of systems and processes that deter fraud, prevent unauthorized access, and protect clients’ personal and financial information.

Cons

- Higher Brokerage Fees: Although HDFC Securities offers a range of benefits, some clients may find that its brokerage fees are relatively higher compared to other providers. This may be a concern for cost-conscious investors seeking to maximize returns and minimize costs.

- Account Maintenance Charges: Apart from brokerage fees, HDFC Securities imposes account maintenance fees for some types of accounts. These fees can accumulate over time, and investors must take them into account when evaluating the overall cost of investing with the firm.

- High Minimum Balance Requirement: HDFC Securities has a high minimum balance requirement for some accounts, which may pose a challenge for novice investors. Consequently, clients must assess whether the firm’s offerings align with their investment objectives and budget.

- Limited Customer Support: While HDFC Securities provides various customer support channels, some clients have reported difficulties in obtaining assistance during high volume trading periods. This can be frustrating for investors who require immediate help or have pressing questions or concerns.

HDFC Securities Contact Details :

- Customer Care: 1800 209 9700 (Toll-Free)

- Email: customerservice@hdfcsec.com

- Registered Office Address: HDFC Securities Limited, I Think Techno Campus, Building – B, “Alpha”, Office Floor 8, Near Kanjurmarg Station, Opposite Crompton Greaves, Kanjurmarg (East), Mumbai – 400042, Maharashtra, India.

HDFC Securities User Reviews and Customer Ratings

| HDFC Securities Customer Ratings | |

| Brokerage Charges & Fees | 8.95/10 |

| Trading Platforms | 8.85/10 |

| Products & Services | 9.15/10 |

| Experience | 9.50/10 |

| Overall Ratings | 8.90/10 |

| Star Ratings | ★★★★ |

HDFC Securities Review – Final Thoughts

In summary, it is vital to highlight that HDFC Securities is an established and reputable stockbroking firm in India, which consistently provides a wide range of high-quality financial products and services that cater to the diverse requirements of investors from all backgrounds.

With its intuitive and user-friendly trading platforms, excellent research and advisory services, personalized investment solutions, and unwavering commitment to ensuring the absolute safety and security of clients’ investments through stringent compliance and risk management practices,

HDFC Securities undoubtedly stands out from its competitors. However, it should be noted that using HDFC Securities has some notable drawbacks, such as higher brokerage fees, which may discourage more budget-conscious investors

Also a high minimum balance requirement that could pose difficulties for some when opening an account.

Therefore, it is imperative for clients to carefully assess their unique needs and preferences before committing to HDFC Securities.

If you already have account with HDFC Securities. please share your review and rankings with other visitors through comments.

HDFC Securities FAQs

Q. Is HDFC Securities better than Zerodha?

A. HDFC Securities is a full-service broker and offers a range of investment services such as trading in equity, derivatives, currency, mutual funds, and IPOs. They provide research and analysis tools, investment advisory services, and dedicated customer support. HDFC Securities charges higher brokerage fees compared to discount brokers like Zerodha.

Zerodha, on the other hand, is a discount broker and offers low brokerage fees for trading in equity, derivatives, currency, and commodity. They are known for their user-friendly trading platform, free investment tools, and high-speed order execution. However, Zerodha does not provide investment advisory services, research reports, or customer support on call.

Ultimately, the choice between HDFC Securities and Zerodha depends on individual needs and preferences.

Q. What is the ranking of HDFC Securities?

A. It's difficult to provide an exact ranking for HDFC Securities as there are different organizations and publications that rank stockbrokers based on different criteria. However, HDFC Securities is considered to be one of the leading and most popular stockbrokers in India, and has won several awards and accolades over the years.

Q. Is HDFC Securities good for beginners?

A. No. HDFC Securities is a full-service broker and charges higher brokerage fees compared to discount brokers like Zerodha. So, beginners should also consider their budget and investment goals before choosing a broker.

Q. Is HDFC Demat account free?

A. No, HDFC Demat account is not free. HDFC Securities charges various fees for opening and maintaining a Demat account with them. These fees can include account opening charges, annual maintenance charges (AMC), transaction charges, and other related charges.

Dont Miss to Read Article Related to HDFC Securities Demat Account: