In 2019, the Securities Exchange of India (SEBI) introduced a game-changing innovation for investors keen on participating in Initial Public Offerings (IPOs) – the integration of Unified Payments Interface (UPI). This move aimed to simplify and secure the IPO application process, making it more accessible for a wider audience.

In this post, we will explain you how you can apply for an IPO through UPI by using common apps such as PhonePe, GPay and Paytm etc.

Understanding UPI

Before we jump into how to apply for an IPO using UPI, let’s take a closer look at UPI itself. Introduced by the National Payments Corporation of India (NPCI) on April 11th, 2016, UPI, or United Payments Interface, is a digital payment system that makes it easy to transfer money between people.

Originally created to make digital transactions more convenient, UPI has now evolved to make it simple for regular folks to apply for IPOs.

Also Read : How to Apply for an IPO in Minor’s Name – What are the pros and cons?

The Need for IPO Allotment via UPI

Traditionally, IPO applications involved physical forms, extensive documentation, and a preliminary check. SEBI aimed to revamp this process to attract more investors.

With the introduction of UPI, investors can now apply for IPOs seamlessly, eliminating the complexities associated with traditional methods.

How to Apply for an IPO with UPI

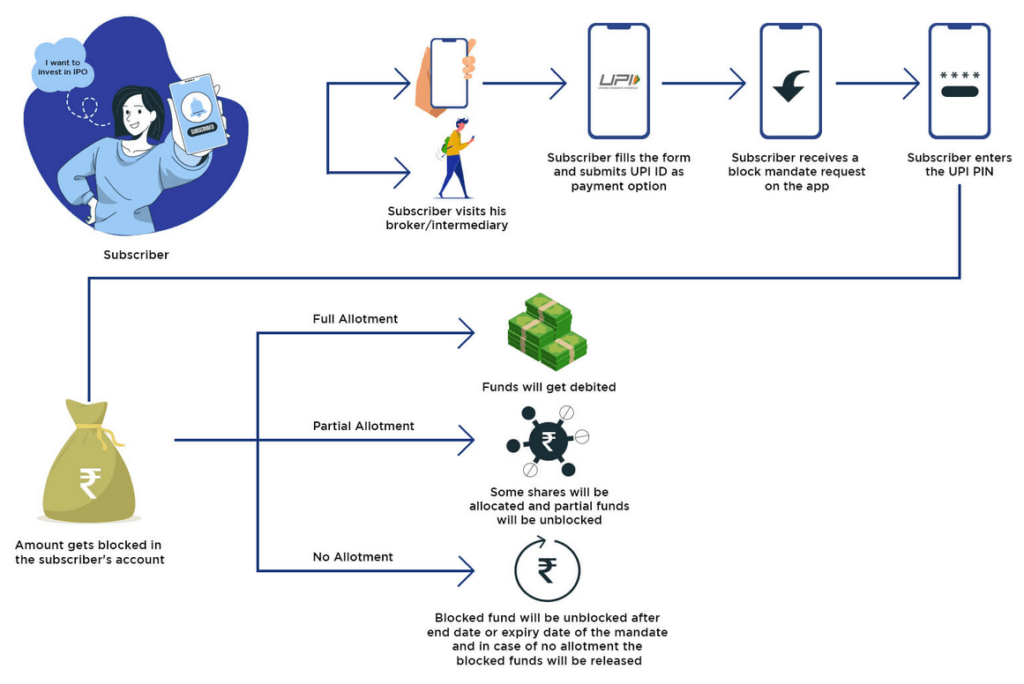

Investing in a company’s IPO using UPI is like buying a piece of that company. It’s become easy – just visit your broker’s website, pick the IPO you like, fill a form, choose UPI for payment (like your phone’s payment app), confirm a request, and voila! You own shares in the company.

Image credit : bhimupi.org.in

Steps to Apply for an IPO Through UPI:

Step 1. Visit Your Broker’s Website or App

If you have a Demat account, the first step is to visit the official website or mobile application of your broker. This is typically the platform where you manage your investment accounts.

Step 2. Navigate to the IPO Section

Once you’re on your broker’s platform, look for the section dedicated to Initial Public Offerings. This section is where you can find information about the available IPOs that you can apply for.

Step 3. Complete the Application Form

Within the IPO section, you’ll find details about the currently open IPOs. Select the specific IPO you’re interested in and proceed to fill out the application form. The form will typically ask for information such as the price at which you want to bid for shares and the quantity of shares you wish to apply for.

Step 4. Choose Your UPI ID as the Payment Method

During the application process, you’ll come across a payment options section. Choose UPI as your preferred payment method. This is where you’ll link your UPI ID, making it the designated mode for transferring funds for the IPO application.

Step 5. Confirm the Mandate Request

After selecting UPI as your payment method, the platform will generate a mandate request. This request is essentially an authorization prompt sent to your UPI-linked mobile application.

Step 6. Authorize the Transaction by Entering Your UPI PIN

Upon receiving the mandate request on your UPI app (such as GPay, Paytm, or PhonePe), open the app, and you’ll be prompted to authorize the transaction. Enter your UPI Personal Identification Number (PIN) to confirm and complete the authorization process.

Step 7. Funds Transfer and Share Allocation

Once you’ve successfully authorized the transaction, the funds required for the IPO application will be transferred from your linked bank account to the issuer. Simultaneously, the allocated shares will be credited to your Demat account.

How to Create a UPI ID for IPO Applications

Creating a UPI ID for IPO applications is simple and can be done in a few easy steps.

- Install a reputable Payment Service Provider app like Paytm, PhonePe, or Google Pay from playstore

- Enter your bank-affiliated phone number.

- Choose a password and link your preferred bank.

- Create a transaction PIN for future use.

Benefits of Applying for IPO with UPI

When you purchase IPO through UPI, it comes with lots of advantages. Below are some of them.

- Security: Your funds are secure until shares are transferred to your Demat account.

- Transparency: The process is transparent and user-friendly.

- Instant Mandate Creation: Real-time submission of applications with instant mandate creation.

- Interest Earnings: Funds remain accessible, and you earn interest until the allotment date.

- Time-Saving: UPI applications are quicker than net banking or ASBA.

- Customer Support: Access customer support through the UPI apps for assistance.

How IPO Allotment Through UPI Works

Applying for an IPO through UPI is a straightforward process that offers several advantages over traditional methods. Unlike the older Application Supported by Blocked Amount (ASBA) system, UPI ensures quicker processing and enhanced convenience.

In case of partial allocation, the remaining funds are accessible, and if no allotment is received, the funds are fully released at the expiry date.

Things to Remember When Applying for IPO Through UPI:

- The UPI payment gateway is exclusively accessible for individual investors.

- Investors can apply for an IPO using the UPI payment mode for amounts up to Rs. 5 lakhs.

- Having a UPI ID is mandatory to utilize the UPI gateway for IPO applications.

- UPI IPO approval of mandate request is a crucial step to finalize the IPO application process.

- If UPI is chosen as the payment mode, the offline IPO application form cannot be submitted to SCSB. Instead, it can be submitted to a Syndicate member, registered stock broker, Registrar, or Depository.

Common Issues Faced While Applying for an IPO Through UPI:

- IPO UPI Mandate expired:

The validity period of each UPI mandate request is determined by the applicant/bank. Investors can verify the IPO UPI mandate’s validity in the UPI app’s “Mandate” section.

In case of expiration, investors must initiate the transaction anew. According to the updated UPI IPO regulations, the UPI mandate request must receive approval before 5 pm on the issue closure date.

- IPO UPI request not received:

If the IPO UPI mandate request is not received within an hour, the investor should delete the previous IPO application and submit a new one.

- IPO UPI mandate failed:

In instances where the IPO UPI payment or authorization fails due to technical issues at the bank or with the UPI app, the original request should be canceled, and a new IPO application request should be submitted.

- IPO UPI mandate revoked:

Should an applicant decide to withdraw or cancel their offer after submitting the application, they can do so by canceling or withdrawing the offer and then revoking the mandate application.

The applicant can revoke (cancel/withdraw) the mandate by contacting the intermediary through which the offer was submitted. Upon revocation of the mandate request, the funds will be immediately released from the account.

Steps to check the IPO UPI confirmation status for bids submitted online:

- Login to the broker platform or Net banking website.

- Go to the IPO/Investment section from where you submitted the bid.

- Go to the Bid history or the click on the applied IPO.

- Investors will see the status of their application as any of the below:

- IPO UPI confirmation status pending.

- Bid submitted successfully.

- UPI Mandate Request pending approval/ IPO UPI mandate pending.

- Bid uploaded to exchange.

- Bid rejected.

What to do in Case of Issues with UPI IPO Application Process?

In the event of any issues regarding the blocking or unblocking of funds or the status of an IPO application, investors are advised to initially approach the relevant intermediary (Broker).

Alternatively, investors have the option to reach out to the bank/SCSB or the registrar for assistance.

For issues related to UPI transactions, investors can register a complaint on the UPI Dispute Redressal Mechanism portal. The investor should choose the appropriate category based on the nature of the complaint, whether it pertains to the transaction, PIN, account, registration, login, or other matters.

They should provide specific details, including the UPI ID, transaction nature, and relevant transaction details. If the investor remains dissatisfied with the resolutions through the aforementioned channels, they have the option to file a complaint with SEBI.

All complaints related to UPI addressed to the intermediaries should have the below details:

- Name of the Applicant.

- Address of the Applicant.

- Number of Equity shares applied for.

- Amount paid on application

- The designated branch of the SCSB where the application form was submitted by the applicant.

Also Read : What is difference between IPO and DIrect Listing (IPO Vs DPO)

Applying for an IPO: Through UPI Vs Through ASBA – Major Differences

The advantages of applying for an IPO through UPI ID can be appreciated when we compare the process with that of the process of applying to an IPO with ASBA.

Below table captures the difference between UPI Vs ASBA.

| Aspect | UPI | ASBA |

|---|---|---|

| Application Process | – User-friendly, completed in minutes | – Involves physical forms and documentation |

| – Link bank account with UPI service | – Typically applied through banks | |

| – UPI ID selected as payment method | – Traditional application process | |

| Fund Blocking | – Only applied capital is blocked | – Entire applied amount is blocked |

| – Remaining funds remain accessible | – May result in significant funds blockage | |

| Time Efficiency | – Real-time processing | – Processing time may be longer |

| – Quick confirmation and authorization | – Release of funds dependent on allotment | |

| User Convenience | – Seamless and convenient user experience | – Involves paperwork and physical visits |

| – Managed through mobile devices | – Potentially less user-friendly | |

| Interest Earnings | – Funds remain accessible, continue to earn interest | – Similar interest earnings during the process |

Final Thoughts:

Nowadays, you don’t need to go to a bank or write a check anymore to make payments. With UPI, you can do it anytime, anywhere, using just your smartphone.

Indian investors no longer have to deal with the hassle of a complicated and paperwork-heavy IPO application process. Now, one can breeze through it in seconds, all thanks to applying for IPOs with a UPI ID.

With UPI, IPO application process is secure, transparent, and time-efficient, ensuring a seamless experience for both seasoned and novice investors.

Frequently Asked Questions (FAQs) – Applying for IPO with UPI

Q1: What is UPI and how does it relate to IPO applications?

Answer: UPI, or Unified Payments Interface, is a digital payment system facilitating seamless money transfers. It is now integrated into IPO applications, offering a secure and efficient method for investors.

Q2: Why should I choose UPI for applying in an IPO?

Answer: UPI streamlines the application process, providing quick, secure, and user-friendly transactions. It allows you to link your bank account, making IPO applications more accessible.

Q3: How is applying for an IPO with UPI different from traditional methods like ASBA?

Answer: Unlike ASBA, UPI allows for quicker processing, with only the applied capital being blocked. The funds remain accessible, offering a more time-efficient and user-friendly experience.

Q4: Can I use any UPI app for IPO applications?

Answer: Yes, you can use any trusted UPI app like Paytm, PhonePe, or GPay for IPO applications. Simply link your bank account, create a UPI ID, and you’re ready to go.

Q5: Is my money secure during the IPO application process with UPI?

Answer: Absolutely. UPI ensures security by blocking only the applied capital until shares are transferred to your Demat account. The remaining funds remain accessible.

Q6: How do I create a UPI ID for IPO applications?

Answer:

- Install a UPI app like Paytm, PhonePe, or GPay.

- Register using your linked phone number and select your bank.

- Create a secure password or PIN for transactions.

- Navigate to the UPI ID creation section and choose a unique ID.

- Confirm the UPI ID creation.

Q7: What happens after I authorize the UPI transaction for an IPO application?

Answer: Upon successful authorization, the funds are transferred, and the shares are allocated to your Demat account. If you receive a partial allocation, the remaining funds are accessible.

Q8: How long does it take to complete the IPO application process with UPI?

Answer: Applying for an IPO through UPI is quick and can be completed in less than a minute, making it faster than traditional methods like net banking or ASBA.

Q9: Can I access customer support if I face issues during the IPO application with UPI?

Answer: Yes, most UPI apps offer customer support. If you encounter any problems, you can contact the Payment Service Provider, such as the UPI app you used for the IPO application.

Don’t Miss to Read Below IPO Related Informative Articles:

- Greenshoe Option in IPO – Meaning, Importance, Example

- What is Red Herring Prospectus (RHP)? Why is it Important in IPO?

- What is Draft Red Herring Prospectus (DRHP) in IPO?

- 7 Key Differences Between IPO and OFS

- What is a Deemed Prospectus in IPO?

- All About Non-Convertible Debentures (NCDs)

- Syndicate Member: Role in IPO, Types and Syndication Risk

- Is PAN Card Mandatory for Applying to an IPO?

- What is Face Value in IPO?: How it is Different From Issue Price

- Price Band in IPOs: How It is decided?

- What is a Shelf Prospectus, Criteria and How Can it Benefit an Investor?

- What is ASBA in IPO? Benefits & Application Process

- 7 Biggest IPOs of India of All Time

- What are the Difference Between Direct Listing and IPO?

- What is Roadshow in IPO and What is its Purpose?